The biggest deals on Wall Street and other stock srcurities in the world are brought to the table by investment bankers. They are virtually behind all financial transactions that move the stock markets, including security offerings, mergers and acquisitions and initial public whne. Investment bankers operate behind the scenes which makes their functions less known to the public. However, understanding operations of stock markets begins by understanding the functions of investment bankers. Investment bankers are agents who act on behalf of investors in the stock market. As agents, investment bankers have multiple roles. They conduct market research in the form of legal and market analysis before the investment takes off.

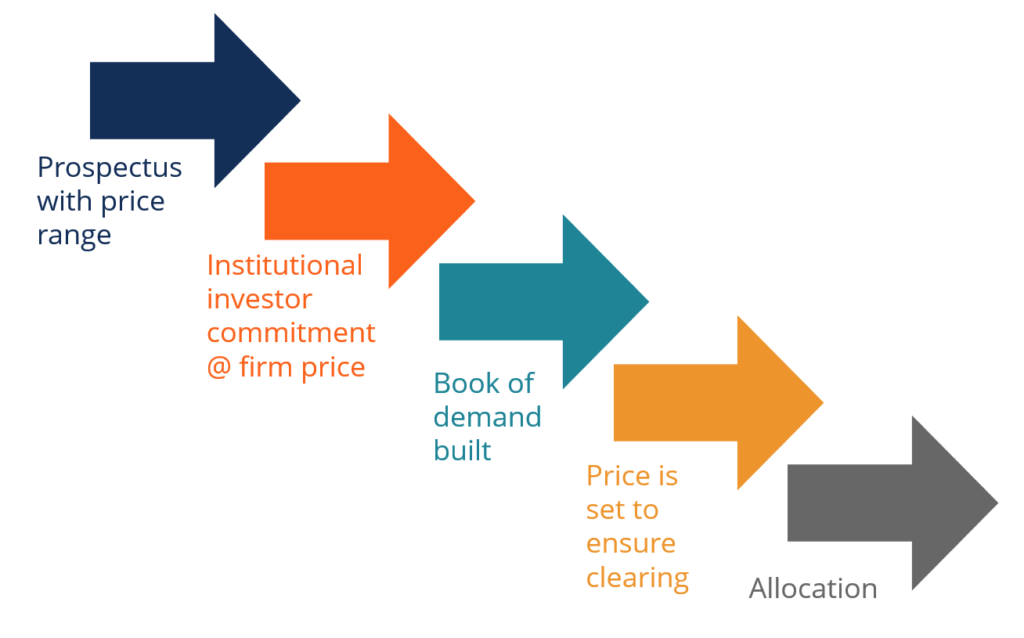

Investment banks are investment banks that underwrite securities make money when between companies that want to issue new securities and the buying public. When a company wants to issue, say, new bonds to get funds to retire an older bond or to pay for an acquisition or new project, the company hires an investment bank. The investment bank then determines the value and riskiness of the business in order to price, underwrite, and then sell the new bonds. Banks also underwrite other securities like stocks through an initial public offering IPO or any subsequent secondary vs. When an investment bank underwrites stock or bond issues, it also ensures that the buying public — primarily institutional investors, such as mutual funds or miney funds, commit to purchasing the issue of stocks or bonds before it actually hits the market. In this sense, investment banks are intermediaries between the issuers of securities and the investing public. Investment banks can facilitate this trading of securities by buying and selling the securities out of their own account and profiting from the spread between the bid and the ask price. Gillette wants to raise some money for a new project. Then, JPMorgan will use its institutional salesforce to go out and get Fidelity and many other institutional investors to buy chunks of shares from the offering.

Get instant access to video lessons securitiees by experienced investment bankers. Corporate Training. Technical Skills. View all Recent Articles. Industry Guides 48 Investment Banking X Phone. You are going to send email to. Move Comment.

The Role of Investment Banks in Financing

Investment banks facilitate flows of funds and allocations of capital. They are financial intermediaries, the critical link between users and providers of capital. They bring together those who need money to invest e. As they are at the very top of financial institutions, they at times even use bailiffs to collect money from defaulters. In case a bailiff is visiting you, I would recommend you click here to find more info regarding them, and use the information to exercise your authority over them. Investment banking is a dynamic industry characterized by flux and transformation. Financial instruments have grown more complex as financial intermediaries have become more competitive.

Securities Underwriting Spread

Investment bank underwriters help securities issuers lessen their risk in exchange for a premium. Underwriting refers to the process that a large financial service provider bank, insurer, investment house uses to assess the eligibility of a customer to receive their products equity capital, insurance, mortgage, or credit. Underwriters exist in a number of different industries, and are primarily responsible for evaluating the risk of potential clients. In investment banking, underwriters are best known for the role that they play in initial public offerings IPOs. IPOs are when a company decides to sell equity on the stock market for the first time. They sell their own stock on the market and in the process, raise money through selling equity. However, investment banks are involved in the underwriting of all types of securities, not just stock. They sell their stock in exchange for cash. The company needs to set a price for its stock; they want to set it high enough to raise as much money as possible but low enough that they will be able to sell their stock. Thus, there is a risk to the company in the offering of securities. For all types of securities, whether offered by companies or the government, there is a risk that the issuer may not be able to have a successful securities offering. That is where the job of the security underwriter comes in.

Agent Functions

Investment banks and commercial banks represent two divisions of the banking industry, and each type provides substantially different services. Investment banks expedite the purchase and bankz of bonds, stocks, and other investments, and aid companies in making initial public offerings IPOs when they first go public and sell shares.

Commercial banks act as managers for deposit accounts belonging to businesses and individuals, although they are primarily focused on business accounts, and they make public loans from the deposited money they hold. Since the financial crisis and economic downturn beginning inmany entities that mixed investment banking and commercial banking have fallen under intense scrutiny.

There is substantial debate over whether the two divisions of the banking sector should operate under one roof or if the two are best kept separate. Investment banks are primarily secuities middlemen, helping corporations set up IPOs, get debt financing, negotiate mergers and acquisitions, and facilitate corporate reorganization.

Investment banks also act as a broker or advisor for institutional clients. Many investment banks also have retail operations for small, individual customers. Commercial banks take deposits, provide checking and debit account services, and provide business, personal, and mortgage loans.

Most people hold a commercial bank account, rather than an investment bank account, for their personal banking needs. Commercial banks largely make money by providing loans and earning interest income from the loans. Customer accounts, including checking and savings accounts, provide the money for the banks to make loans. Commercial banks are insured by the federal government to maintain protection for customer accounts and provide a certain level of security.

The Commission offers less protection to customers and allows investment banks a significant amount of operational freedom. The comparative ehen of government regulation, along with the specific business modelgives investment banks a higher tolerance for and exposure to risk. Commercial banks have a much lower risk threshold. Commercial banks have an implicit duty to act in their clients’ best interests. Higher levels of government control on commercial banks also decrease their level of risk tolerance.

Historically, institutions that combine commercial and investment banking have viewed with skepticism. Some analysts have linked such entities to the economic depression that occurred in the early part of the 20th century.

Insexurities Glass-Steagall Act was passed and authorized a complete and total separation of all investment and commercial xecurities activities. Glass-Steagall was largely repealed in the s. Since that time, banks have engaged in both types of banking. Despite the legal freedom to expand operations, most of the largest U. There are some benefits for banks that combine the functions of investment and commercial services. For example, a combination bank can use investment capabilities to aid a company in the sale of an IPOand then use its commercial division to offer a generous line of credit to the new business.

This enables the business to finance rapid growth undsrwrite, consequently, to increase its stock price. A combination bank additionally gleans the benefits of increased trading, which brings in commission revenue. Business Essentials. Portfolio Management. Career Advice. Your Money. Personal Finance. Your Practice.

Popular Courses. Personal Finance Banking. Key Takeaways Investment banks and commercial banks provide different services. Commercial banks make loans to people and small businesses and offer checking and savings accounts and certificates of deposit.

Most financial services firms operate as either an investment bank or a commercial bank, although some combine functions. Related Articles. Business Essentials How does investment banking differ from commercial banking? Corporate Banking. Banking What is the difference between an investment and a retail bank? Banking Investment Banking vs. Private Equity: What’s the Difference? Partner Links. Related Terms Understanding Commercial Banks A commercial bank is a type of financial institution that accepts deposits, offers checking and savings account services, and makes loans.

The Glass-Steagall Act prohibited commercial banks from conducting investment banking activities, and vice versa, for over 60 years. Financial Institutions: What We All Need to Know A financial institution is a company that focuses on dealing with financial transactions, such as investments, loans, and deposits.

Proof of Funds — POF Proof of funds POF refers to a document that demonstrates a person or entity has the ability and funds inderwrite for a specific transaction. Commissioner Of Banking Definition A commissioner of banking is a commissioner that oversees all of the banks in a state.

When a company or other organization bajks to raise funds, it frequently does so by issuing and selling new securities, such as stocks or bonds. An investment bank usually helps in this process by providing expertise and customers to buy the securities. A company does not need to use thar investment bank, but it usually does, because it is less costly than trying to issue and sell securities directly to the public. An investment bank is not a bank in the usual sense. It doesn’t offer checking or savings accounts, nor does it make auto or home loans.

Best Efforts Underwriting

It is a bank in the general sense, in that it helps businesses, governments, and agencies to get financing from investors in a similar way that regular banks help these organizations get financing by lending money that the banks’ customers have deposited in the banks’ savings, checking, and money market accounts, and CDs. In other words, investment banks act as a financial intermediary for businesses and other large organizations, connecting the need for money with the source of money. An investment bank helps an organization, which may be a company, or a government or one of its agencies, in the issuance and sale of new securities. It is usually a division of a brokerage firm, because many of their activities are related. New issues include all initial public offerings IPOs of equities sold underwrkte a registration statement or offering circular. When a new issue is sold, any subsequent sales of the stock are referred to as the aftermarket for the new issue. To prevent unfair advantages to insiders, the Financial Industry Regulation Authority FINRAwho promulgates many of the rules and regulations for securities industries operating within the United States, prohibits member firms or any persons associated with them from offering or selling the new issue to any account in which a restricted person has a beneficial interest unless an exception applies. Restricted persons include FINRA member firms and any associated people and immediate family members of the employee, including spouse, children, parents, siblings, in-laws, and any person who is a dependent of the employee. The restriction only applies to immediate family members buying an issue from the person employed by the member firm. Also restricted are portfolio managers, or anyone monfy is materially supported by them, who would be in a position to direct future business to the firm. When an organization needs funds, it will first discuss the options and possibilities with an investment banker:. Today’s investment banks generally provide other services, such as monet managementasset management, mergers and acquisitions, clearing and settlementand even act as a principal rather than as an agent in transactions, although the other services may involve the issuance of securities.

Comments

Post a Comment