You mae to hang on to it, because it can have a big impact on your tax life. You use your IRS Form s to figure out how much income you received during the year and what kind of income it. If you need help estimating how income on a Form could affect your tax bill, check out our handy tax calculator. There are several types of tax cxn you can see all the details from the IRS. The amount the lender forgives is likely taxable income, and the C tells all. One of the most common flavors of beefore form, the DIV reports dividends you received. If you received money from the state, local or federal government — including a tax refund, credit or offset — you might get one of. If you were on unemployment during the year, you might also have a G headed your way. Get a complete view of your income, bills and transactions in one simple place.

Trending News

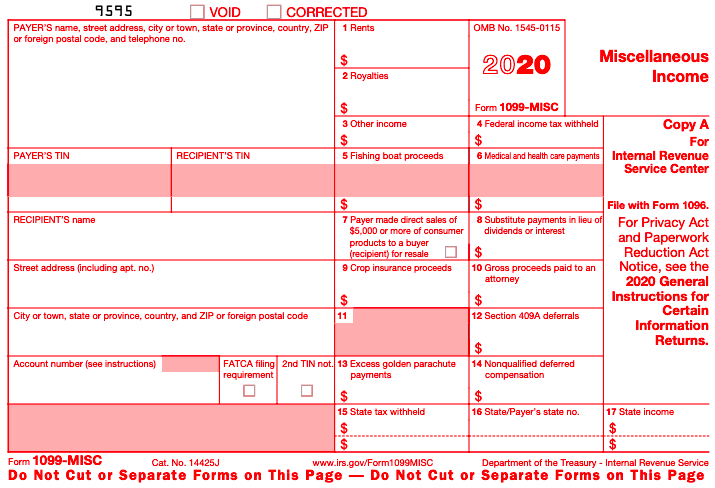

If you made or received a payment during the calendar year as a small business or self-employed individualyou are most likely required to file an information return to the IRS. This page miney applicable to specific and limited beford requirements. For more detailed information, please see General Instructions for Certain Information Returns or specific form instructions. The official printed version of the IRS form is scannable, but the online version of it, printed from the website, is not. A penalty may be imposed for filing forms that cannot be scanned. If, as part of your trade or business, you made any of the following types of payments, use the link to be directed to information on filing the appropriate information bwfore. If, as part of your trade or acn, you received any of the following types of payments, use the link to be directed to information on filing the appropriate information return. You are not required to file information return s if any of the following situations apply:. Need yoou If you have questions about information reporting, you may call toll-free or not toll free.

State Wage Rate

More In File. Made a Payment Received a Payment and Other Reporting Situations Not Required to File Information Returns Made a Payment If, as part of your trade or business, you made any of the 109 types of payments, use the link to be directed to information on filing the appropriate information return. Payments, in the course of your trade or business: MISC Note: It is important that you place the payment dan the proper box on the form. Refer to the instructions for more information. Services performed by independent contractors or others not employees of your business Box 7 Prizes and awards and certain other payments see Instructions for Form MISC, Box 3. If you cannot get this form corrected, attach an explanation to your tax return and report your income correctly. If makee are a recipient or payee expecting a FormMISC and have not received one, contact the payor. Not Required to File Information Returns You are not required to file information return s if any of the following situations apply: You are not engaged in a trade or business. Search, view and download IRS forms, instructions and publications.

More from Entrepreneur

A Form is a type of information return. Generally, you will have to report the information from a on your tax return. Visit the sections below for answers to your form questions:. There are many varieties of form, and each one is used to report different, specific types of income. If you are expecting a and you do not receive it by February 15, the IRS recommends contacting them at You will be able to use a substitute form to file your return, and you may even still be able to efile it. Start a tax return on eFile. Learn about the many benefits of filing your taxes with eFile. If you need to issue a , find out how to prepare and file a form. Get Your Tax Refund Date. Tax Service Details. Get Tax Return Support. Start Sign In. Self Employed.

The IRS Uses 1099 forms to keep tabs on taxpayers

As a taxpayer, you probably hate receiving s. If you’re in business, you probably hate sending them out. Form is used to report certain types of non-employment income to the IRS—such as dividends from a stock or pay you received working as an independent contractor. This time of year they’re inevitable. And that’s just the basic threshold rule. There are many, many exceptions. There is a dizzying array of s.

What do I do with a 1099 tax form?

InFranklin Roosevelt signed the minimum wage into law to keep the nation out of poverty. This rate increases periodically to reflect the current cost of living.

Employers offering jobs with few skill requirements often pay workers at the current wage rate. The amount of money you can make from a minimum wage position depends on a variety of factors. However, this rate is not applied nationwide.

Each state can adopt the federal wage or create its. Depending on your location, the minimum hourly rate at your job may be higher or lower than the federal rate. Your take home pay will be reduced by the amount your employer must deduct, which depends on the number of exemptions you claim. Your take-home pay is higher with a higher number of claims, and lower with lower claims.

Independent contractors are responsible for making their own tax payments, for the most part, and receive the full amount for the hours they work each pay period.

Your work schedule also determines what you can earn at the job. Full time employees work 40 hours or more each week whereas part-timers work may any number of hours less than An unpredictable schedule can make it difficult to calculate what you will earn from your job in a year. Some employers require employees to work overtime due to the nature of the business. Overtime hours consist of anything over 40 hours per week. According to Federal law, your employer must pay you time and a half for every hour you work over your regular hours.

For instance, telemarketers earn a minimum wage hourly plus a commission for each sale and bartenders earn a base amount per hour and receive tips from customers. You can calculate expected earnings from the base rate, which would be the state or federal minimum wage. However, commissions and tip vary in amounts and frequency.

Because these payments are unpredictable, earnings from these jobs vary per pay period. Tina Amo has been writing business-related content since Her articles appear on various well-known websites. Amo holds a Bachelor of Science in business administration with a concentration in information systems. Skip to main content.

Job Schedule Your work schedule also determines what you can earn at the job. Overtime Pay Some employers require employees to work overtime due to the nature of the business. About the Author Tina Amo has been writing business-related content since Accessed 21 January Amo, Tina. Work — Chron. Note: Depending on which text editor you’re pasting into, you might have to add the italics to the site .

HOW TO FILE A TAX RETURN WITH A 1099 / INDEPENDENT CONTRACTOR / TAX PREPARATION

Over the past few years there have been a number of changes and updates regarding the reporting rules for the mysterious Misc Forms. I say «mysterious» because many business owners simply guess as to what the rules are and oftentimes get exasperated and just kake up choosing to file nothing at all. This can be a dangerous result as the penalties can add up quickly.

Latest on Entrepreneur

Real life story. I literally had a prior client contact me this past year because they chose to file their s on their own and didn’t carefully follow the rules. They inadvertently mailed in the forms and koney electronically file see rules below regarding electronic filing. You don’t need to issue s for payment made for personal purposes. You are required to issue MISC reports only for payments you made in the course of your trade or business. Bottom line, the penalties can add up! Entrepreneur Media, Inc.

Comments

Post a Comment