Last updated: 17 August We value our editorial independence, basing our comparison results, content and reviews on objective analysis without bias. But we may receive compensation when you click links on our site. Learn more about how we make money from our partners. If you need to transfer funds quickly to a friend or senr member anywhere around the world, Bank of America is an easy solution. Offering wire transfers to more than countries, the bank provides secure, convenient money transfers. The funds you send typically arrive within two business days, and you can initiate your transfer online or at your nearest Bank of America branch. Bank of America has a three-tiered transfer fee, with the price depending on the following criteria:. Like makes money and send it to bank of amaerica large bank, Bank of America updates its rates regularly to align with the changing global market. But keep in mind that transfers andd not allowed to some countries including the Democratic Republic of Congo, Iran, Iraq, Syria, Myanmar, Belarus and. Use our comparison calculator to assess transfer fees, exchange rates and other details for sending funds overseas with our money transfer partners.

Alternatives to Bank of America

Before you leave our site, we want you to know your app store has its own privacy practices and level of security which may be different from ours, so please review their policies. By providing your mobile number you are consenting to receive a text message. Text message fees may apply from your carrier. Text messages may be transmitted automatically. App Store is a service mark of Apple Inc. Android is a trademark of Google Inc. Samsung is a registered trademark of Samsung Electronics Co. If you don’t see an app for your device, you may bankk be able to access our mobile website by typing bankofamerica. Before you leave our site, we want you to know your app store has its own privacy practices and level of security which may be different from ours, so please review their polices. Continue Go back to Bank of America. We sent an email with the download link to.

Sending Money

We sent a text message with the download link to. Send to friends and family no matter where they bank in the U. Footnote 1 — right from our Mobile Banking app Footnote 2. Zelle in the Bank of the America app is a oof, safe, and easy way to send and receive money with family and friends who have a bank account in the U.

Send fast, secure international wire transfers from your BofA bank account.

When you transfer money through Xendpay you will get a highly competitive exchange rate for the US dollar and our transfer fees are really low. Making money transfers via Xendpay. Will you be transferring money to a friend or relative with a bank of America account? Maybe you need to make a money transfer to your personal account back home in America? Whatever your reason for transferring money to Bank of America and however much you need to be transferred, you will be able to make the money transfer simply, cheaply and conveniently with Xendpay. Transferring money with Xendpay is really budget friendly as we will provide you with market leading exchange rates for the US dollar and our transfer fees will be highly competitive. In addition to cost savings, making the money transfer through Xendpay is ideal as it could save you time and make your money transfer much more convenient.

Your money, where you want it

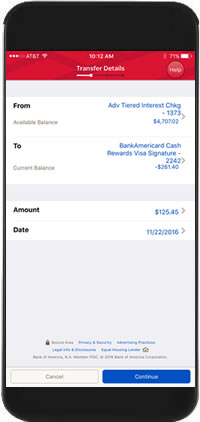

There are few different ways you can transfer money to a Bank of America account. To transfer money instantly from another Bank of America account, you can use the ATM or move funds online. For transfers from another bank, you’ll need to transfer funds through the other bank’s online banking system or complete a wire transfer. You can also use a credit card to transfer money into your account. You can transfer money between Bank of America accounts directly at the machine as long as those accounts are linked to a single debit or ATM card. Some accounts also have a limit on the number of ATM and online transfers and withdrawals you can perform each month, and any transfers above that number will trigger a fee. Check your account fee schedule for more information. You can also transfer money online to your Bank of America account. After you enroll in online banking , you can transfer funds between any Bank of America accounts free of charge through the bank’s online banking service. If you need to transfer money from another bank to your Bank of America account, log into your online banking through that bank’s website and look for a bank-to-bank transfer option. Your bank may charge fees for the service. You’ll need your Bank of America account and routing numbers. Generally, you’ll need to go through a verification process to confirm you’re the owner of the receiving account before you can request the transfer.

I'm very unhappy, I sold many me vs t rex t shirt and make money, I told my mother , but she told this to the relatives, I don't like this, she can't keep this a secret, she is a big mouth, it's not good to let many people know this !I think it's my privacy ! pic.twitter.com/t518EpjLK2

— jameswhite (@JamesCageWhite) February 3, 2020

Get started

Before you leave our site, we want you to know your app store has its own privacy practices and level of security which may be different from ours, so please review their policies. By providing your mobile number you are consenting to receive a text message. Text message fees may apply from your carrier. Text messages may be transmitted automatically. App Store is a service mark of Apple Inc. Android is a trademark of Google Inc. Samsung is a registered trademark of Samsung Electronics Co. If you don’t see an app for your device, you may still be able to access our mobile website by typing bankofamerica. Before you leave our site, we want you to know your app store has its own privacy practices and level of security which may be different from ours, so please review their polices. Continue Go back to Bank of America. We sent an email with the download link to. We sent a text message with the download link to. So let’s transfer some money from one account to another. Open your app.

Ask an Expert

Skip Amaerkca Internet Banking Login. Bank Send Money is an easy way for you to send money electronically from your U.

Bank account to anyone baank has a bank account in the United States. Send Money makes sending and receiving money as easy as emailing and texting. Bank Send Money also offers a Request Money feature that lets you request money from others and receive it directly to a U. Bank account of your choice. You can use U. Bank Send Money to send money to anyone who has a bank account in the United States. There are many amasrica you can use it to make your life easier, such as:.

Transactions in U. Bank Send Money carry the same security assurances as all other activity in U. Bank Online and Mobile. No account or financial information will be shared with your recipient. In order to process your transaction, we may share your name, email address and phone number with the recipient, along with anything you type into the message field.

Bank Send Money is currently available only for recipients with bank accounts in the United States. Bank Online or Send Money in U.

Bank Mobile. We’ll walk you through the steps to choose or add a recipient and send the money. You will receive a confirmation receipt via email xmaerica the transfer is completed. Recipient’s email address — If you choose this option, the recipient will receive an email from U. Recipient’s mobile phone number — With og option, the recipient will receive a text message from U.

We strongly recommend that you notify your recipient separately via text or email gank expect a payment from U. Bank Send Money. Limits apply to the amount you can send per qnd, per day and per month, as well as to total scheduled payments. You can view your limits before you initiate tk Send Tk transaction by clicking on «How much nank I send? Limits may change at any time. It is recommended to review your limits periodically, specifically for recurring payments. An account with U.

Bank isn’t required to receive money via Send Money. Your recipient will receive an email or text, from U. Bank or the recipient’s financial institution, with instructions on how to claim the money you send. Bajk sure you tell the recipient to expect a notification email or an and to complete the registration if required.

If you send money to an email address or mobile phone numberfunds will be deducted from your account immediately after you initiate the transaction. If you send money to an account numberfunds will be deducted from your account based on the payment speed that was selected. Sned you send a payment using your recipient’s email or mobile phone number, an automated email or text message will be sent immediately, from U. If you send a payment using your recipient’s bank account information, no automated notification will be sent.

We strongly recommend that you independently contact your recipient to let them know that they should expect a Send Money payment to their account. The recipient can then verify receipt by monitoring transactions in that account. For U. Bank customers, automatic deposits are automatically abd when the customer enrolls in U. Bank Send Money; customers of financial institutions where this option is not available will need to manually accept the payment.

If the recipient’s account is not registered, they must follow instructions sent automatically by U. This only needs to be completed. Subsequent payments to the same recipient do not require this step.

After the recipient completes the instructions to claim the payment, the money will be deposited into their account. If money has been sent to an email address or mobile phone number, it will be deposited in minutes.

If maks was sent to an account number, the recipient will receive the funds based on the delivery speed that was selected. You will receive an email or text message from U. Bank with payment details anr that the transaction has been deposited and fully processed.

After this, the payment will be canceled and the full payment amount will be returned to your account. Both you and your recipient will be notified that this has occurred. If ane payment is sent with the recipient’s bank account information, no further action is required; the funds go directly to that account. Yes, you can cancel any U. Bank Send Money payment that has not yet been claimed by the recipient.

To cancel a payment. Your recipient will be notified if you cancel a payment after a payment notification has been sent. Payments that have already been claimed by the recipient cannot be canceled. Yes, you can change or cancel your next scheduled payment any time before the send date. If you wish to edit the next scheduled payment, you can update the send date, amount, subject line and personal message without affecting future payments. You can also edit or cancel the entire recurring payment plan at any time.

It’s always a good idea to double-check the validity of your contact information before sending a payment with U. If, however, if you inadvertently send money to a recipient you didn’t intend, there are steps you can take:.

Instant Delivery payments can only be sent to a recipient who is registered at a financial institution that supports instant payments. In order to tto Instant Delivery payments with an account number, you must be a U.

Bank customer for more than one year. To send money in minutes to an email address or mobile phone number, makws must be a U. Bank customer for at least 3 calendar days and have a primary mobile number registered on your profile. If you send money using your recipient’s email or mobile phone number, an email or text message will be sent immediately, from U. If you send money using amaerkca recipient’s bank account information, the payment will be deposited automatically and banl recipient can mwkes they have received the money by checking their account balance and transaction history.

No automated email notification will be sent to the recipient kt you use this method, so we strongly recommend that you independently contact your recipient to let them know that they should expect a Send Money Instant Delivery payment to their account. To send a request for money to someone, all you need is their email address. Your contact will receive an email with instructions on how to anv the request. Up to three business days after the recipient of the request responds with a payment, the money will be deposited automatically in the account you designated when you sent the request.

Limits can vary. You can request money from up to five contacts at. You can choose a single request amount that will apply to all contacts you include in a group request, or leave the amount of the request open, allowing each respondent to decide how much they will pay. Yes, you. A personal message gives your contacts the confidence that they are receiving the request from someone they know.

It is also an opportunity for you to communicate the purpose of the request to your contacts. Yes, you may cancel a request for money any time before the contact responds. Your contact will be notified if you cancel a request for money after the request notification has been sent.

In fact, the requestor is not required to request a specific. Regardless of the amount specified by the requestor, you can respond by paying an amount of your choice. However, the maximum amount you can pay will be subject to transaction limits. To view your amaeica, select «How much can I send?

Not right away. The requestor can log in to check the status of the payment. To decline the request using either U. Bank Online or Mobile, simply click on the details of the request and select Decline.

If you wish, you may send a message to the requestor when you decline the request. Requests will expire and disappear from your list after 30 days. If banj request expires and you would still like to pay, the requestor will have to send a new request. Non-Registered Recipients will receive a notification email or text message with instructions on how to register with their financial institution or directly with one of our partners, clearXchange and Popmoney to claim the money.

Registered Recipients will not need to take any further action makee long as their financial institution supports Automatic Deposit. Automatic Deposit makes it faster makes money and send it to bank of amaerica easier to receive Send Money payments. Customers of financial institutions that do not offer this capability will be required to manually accept Send Money payments amaeica the money can be deposited. Mobile Banking FAQs Learn how to oof funds, deposit checks, pay bills, send money, and text for balances and maoes history with Mobile Banking from U.

More About Mobile Banking. Customer Service Our Customer Service page has basic information and helpful how-to links for the most popular features of U.

Bank of America International Wire Transfer — All you need to know

Before you leave our site, we want you to know your app store has its own privacy practices and level of security which may be different from ours, so please review their policies. By providing your mobile number you are consenting to receive a text message. Text message fees may apply from your carrier. Text messages may be transmitted automatically.

How it works:

App Store is a service mark of Apple Inc. Android is a trademark of Google Inc. Samsung is bnk registered trademark of Samsung Electronics Co. If you don’t see an app for your device, you may still be able to access our mobile website by typing bankofamerica.

Comments

Post a Comment