It was once possible to start collecting Social Security SS benefits at 62, the earliest possible age, and then, at the age of 70, repay all the money you’d received from the Social Security Administration SSA and refile for benefits as if you’d never gotten a single check. Because you were now older, the amount of your monthly check would be higher, and all the cash you had received over the years from the SSA was like an interest-free government loan. That loophole was closed in so you can no longer «borrow» money from the SSA for a number of years. You now have only one year after you start receiving benefits to decide to repay them and put off collecting them again until a later date. Another way of gaming the system and getting extra money from the SSA—this one involving a married couple—was permitted for a few more years. In this practice, known as » file and suspend ,» the higher-earning spouse would apply to receive SS benefits as soon as they reached their full retirement age FRA. Doing so would enable their spouse to begin collecting spousal benefits—half of the filer’s benefits. The filer would immediately suspend his application to receive benefits, but the spouse could still continue to collect the spousal benefits.

1. Blogging

Social Security retirement benefits are calculated based on your lifetime earnings — specifically, your highest 35 years’ worth. The age at which you first file for benefits also dictates how much money you receive in benefits each month. If you file for benefits at your full retirement age which, depending on your year of birth, is either 66, 67, or somewhere in between those two agesyou’ll get the full monthly benefit your work record entitles you to. But you don’t have to wait that long to claim benefits — you’re allowed to start collecting as early as age And make no mistake about it: A large number of seniors each year jump at the chance to get their benefits as early as possible, making 62 the most popular age at which to file for Social Security. The problem with taking benefits that soon, though, is that in doing so, you’ll reduce them by a substantial. Specifically, your benefits will take a 6. But what if you find yourself desperate for money come age 62? What if your home needs a major repair, your vehicle is totaled, or you find yourself out of work? Filing for benefits won’t be ideal, because in doing so, you’ll risk reducing them for life. But racking up costly credit card debt isn’t a great solution. If only there was a way to «borrow» that money from Social Security for a while and then pay it back to avoid taking a permanent hit on your benefits. Well, guess what: There is a way to use Social Security as a loan of sorts. You just need to go about it carefully.

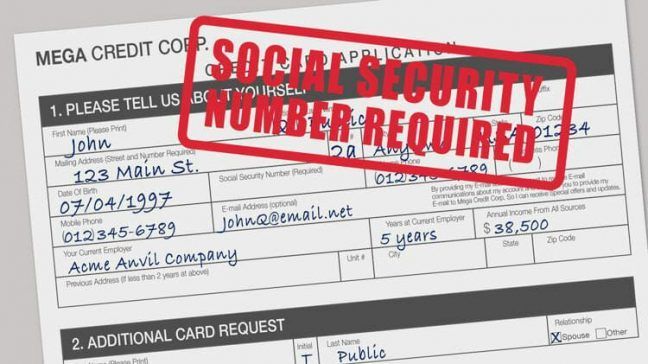

Hackers can use your SSN to get credit cards in your name.

Many people who file for Social Security ahead of full retirement age do so because they need the money — not because they’re actually ready to retire. If that’s your situation but you don’t want to permanently reduce your benefits due to a one-time need, you can file early and use those payments as a loan. How is this possible? Social Security allows filers one do-over in their lifetime. If you file but then withdraw your application for benefits within 12 months and pay back all of the money you received from Social Security, you’ll get to start over with a clean slate — meaning you can file again at a later age and secure a higher monthly benefit. Let’s say you lose your job right when you turn 62 and don’t have savings to tap in the interim while you look for a new position.

We’ll Be Right Back!

With the Equifax breach still fresh in our minds, many of us are wondering if our finances—let alone our identities—are safe and secure. What exactly can a thief do with your Social Security number? One of the identity theft-related crimes most people think of is credit card fraud. However, credit card fraud may be just one of the crimes that can be committed if a criminal assumes your identity with your Social Security number and other personal information. While stolen credit cards and the like can be cancelled and replaced, it can be difficult to obtain a new Social Security number.

Expenses piling up? Empty bank account at the end of the month? Look for ways to increase your income. Take a free online marketing course, do odd jobs for a neighbour or use your 2nd language to do some translation. You’d be surprised how many ways you can make extra cash. 👍💫 pic.twitter.com/QcDvOIL8WP

— Manulife Bank (@manulifebank) January 29, 2020

It’s tricky to pull off — but it can be done.

The major difference is that you can get a new bank account number, while the Social Security Administration very rarely issues new Social Security numbers. Whenever you start a new job or apply for government benefits, you need your Social Security number: it will be used to verify your identity and record earnings. How someone finds out and steals your identity or Social Security number can happen in a variety of ways. They could gain your Social Security number by exploiting data breaches, sifting through the trash for personal documents, or using any number of other approaches. The thieves can then sell your identity to the highest bidder on the dark web. More: Money worries? More: Take that, Miami: Pittsburgh is top retirement spot. Once an identity thief has your Social Security number, they can commit all sorts of financial fraud with it, potentially leaving you on the hook for their misconduct. Below is a list of just a few things someone can do with your SSN if they get their hands on it. Your Social Security number is the most important piece of personal information a bank needs when extending you credit or opening an account. Once you spot suspicious transactions, you can use your credit scores and credit reports to detect fraud and put an end to it. Inaccurate medical records can have deadly consequences — for example, imagine what could happen if you received treatment based on a false history listing the wrong blood type. Taxpayer identity theft is a growing problem.

They can use your SSN to open a phone account in your name.

Created merely to keep track of the earnings history of U. Assigned at birth, the SSN enables government agencies to znd individuals in their records and businesses to track an individual’s financial information. The author also wishes to thank the many employees in the Office of Income Support Programs and uee Office of Earnings and Enumeration and Administrative Systems who reviewed the article for technical correctness. The findings and conclusions presented in the Bulletin are san of the authors and do not necessarily represent the views of the Social Security Administration. Since then, use of the SSN has expanded substantially.

A loophole that basically let you get a loan from the SSA was closed.

The SSN ‘s very universality has led to its adoption throughout government and the private sector as a chief means of identifying and gathering information about an individual. How did the SSN come to be, and why has it become an unofficial national identifier? At its inception, the SSN ‘s only purpose was to uniquely identify U. That is still the primary purpose for the SSN. Additionally, the U. One of the first steps in administering the Social Security Act was to devise a means to track the earnings of each individual, as Social Security benefit computations consider a worker’s earnings from on. Why didn’t the Social Security Board just use an individual’s name and address as the identifier? The deficiency of such a scheme was already well known. A publication recounts, «A recent news account states that the Fred Smiths of New York City have had so much trouble in being identified by their creditors, the courts, and even their friends, that they have joined together in forming the ‘Fred Smiths, Incorporated,’ to serve as a clearing house for their identification problems. War and Navy Departments, the Veterans Administration for paying pensions and for adjusted compensation certificatesand the Post Office Department for Postal Savings depositors used fingerprints for identification. A numbering scheme was seen as the practical alternative. Today we take the 9-digit composition of the SSN as a given, but in and many other schemes were considered.

Comments

Post a Comment