Like many Canadians you could be making mistakes that are costing you money in penalties and unnecessary taxes, or causing you to miss opportunities to grow your wealth. Here are five mistakes to avoid when managing your TFSA. Perhaps the most common error TFSA owners are making is overcontributing. While the numbers are down, thousands of tax filers still receive letters moey the Canada Revenue Agency each year concerning over contributions. To curb the penalty you must withdraw the excess funds or wait for enough contribution room to be created the next year or in later years to absorb the overcontribution. You can overcontribute to your TFSA in two ways. First, you can simply put too much money into your account. How much is too much? A more subtle cause of overcontributing stems from misunderstanding the consequences of make money tax free savings account from a Txx and then re-contributing the funds frew the same calendar year.

Free Brochures & Guides

Commission-free stock trading. File your tax return online. Andrew Goldman. Andrew Goldman has been writing for over 20 years and investing for the past 10 years. He currently writes about personal finance and investing for Wealthsimple. He and his wife Robin live in Westport, Connecticut with their two boys and a Bedlington terrier. Our content is made possible by clients who pay for our smart financial services. Learn more about us.

What are the different types?

Why is that? A TFSA Tax-Free Savings Account is an account that allows your investments grow tax free so the government doesn’t make an Despite savings in the name, it can not really much at all like those savings accounts you had as a kid—ones that earned almost no interest but provided access to all-you-can-eat stale lollipops from your local bank branch. Instead, think of a tax-free savings account TFSA as a basket. You can pick what to put in that basket from a bevy of financial instruments—exchange traded funds, guaranteed investment certificates, stocks, bonds and yes, actual savings accounts. How a TFSA works is very simple. You open a TFSA, deposit money and hopefully watch your money grow.

What is a TFSA?

Have a moment? We love our community and want to know what you think. A Tax-Free Savings Account is a type of bank account. With a regular savings account, you have to pay tax on the interest you earn. Find more information about your tax status in Canada. For more information about your specific situation, contact the Canada Revenue Agency. As well, you can take money out of your TFSA at any time without paying taxes on it. Who is eligible for a TFSA? For example, The types of investments allowed How much money you can put in If you put in too much For more information about your specific situation, contact the Canada Revenue Agency.

How does a TFSA work?

You can think of a TFSA like a basket, where you can hold qualified investments, that may generate interest, capital gains, and dividends, tax-free. Whether you’re saving for your dream wedding, a rainy day, your first home, or an extended vacation, a TFSA can help you reach your goals sooner. To get you started, we break down: what is a TFSA, how it works, and how it can benefit your savings plan. Ready to get started? You can hold qualified investments like cash, stocks, bonds, mutual funds in a TFSA and can withdraw the interest, capital gains, and dividends earned in the account at any time 1 , without paying taxes or reporting the withdrawals as income when you file your taxes. This limit is known as the contribution room. The contribution room begins to accumulate every year, if any time in the calendar year, a Canadian resident is 18 years and older. If you don’t contribute the maximum amount set for a given year, this amount is carried forward and is added on to your contribution room for future years. Learn more about contribution limits and withdrawal rules.

Where do you live?

Investment ISAs put your capital at risk, and you may get back less than you originally invested. Individual Savings Accounts, or ISAs, let you earn money tax free when you save or invest, but there are several different types to choose.

It is a tax free savings account that lets you save without any risk to your money from stock market volatility. It is an account that lets you invest your money in a range of stocks and shares while keeping a tax free status on any returns you make. Your money is at risk in a stocks and shares ISA, meaning you have the potential to make or lose money depending on how the stock market performs.

This is a tax free way of growing your money and the returns offered are usually higher than rates offered by cash ISAs. Innovative finance ISAs are not protected under the FSCSbut some companies use their own protection scheme, so make sure you understand the risk before investing. You do not need to spread your allowance between each type of ISA. You can use your entire allowance in any way to try and get the best return.

As many as you want, but you can only pay into one cash, stocks and shares and innovative finance ISA during the same tax year.

Find out more. Only if the ISA allows withdrawals but there are restrictions on paying money back in, find out more. Most let you track the performance online or you could also ask your financial advisor for a valuation if you invested through one. Read this guide for. Here is more information about how our website works. We have commercial agreements with some of the companies in this comparison and get paid commission if we help you take out one of their products or services.

We don’t sell your personal information, in fact you can use our site without giving it to us. If you do share your details with us, we promise to keep them safe. Our data experts check the companies we list are legit and we only add them to our comparisons when we’re happy they’ve satisfied our screening. We’re totally passionate about giving you the most useful and up to date financial information, without any fancy gimmicks.

We use cookies to improve our service and allow us and third parties to tailor the ads you see on money. By continuing you agree to our use of cookies. Find out. Our website is completely free for you to use but we may receive a commission from some of the companies we link to on the site.

How money. We are classed as a credit broker for consumer credit, not a lender. How we order our comparisons. Refine results. Show me affiliated products. Account type. Open. Interest rate. Protection scheme. ISA transfers in. The listings above are affiliated with us. This account is only available in certain areas of the UK.

Available in branch. Which ISA should you choose? What are the different types? Find out how cash ISAs work. Find out how stocks and shares ISAs work. Find out how innovative finance ISAs work. How many ISAs can I have? Is my money safe in a cash ISA?

Is my money protected in an investment ISA? How can I track the performance of my investment ISA? Who do we include in this comparison? How do we make money from our comparison? You do not pay any extra and the deal you get is not affected.

Related guides. Why check with us? We don’t sell your data We don’t sell your personal information, in fact you can use our site without giving it to us. We check out every company we list Our data experts check the companies we list are legit and we only add them to our comparisons when we’re happy they’ve satisfied our screening. We’re a team of money experts We’re totally passionate about giving you the most useful and up to date financial information, without any fancy gimmicks.

OK, I accept. All rights reserved.

Advertiser Disclosure

Tools and Resources. Plus, get a first-year annual fee rebate! Learn more About earning 35, Aventura Points. Learn more about the mohey transfer offer.

Financial Articles

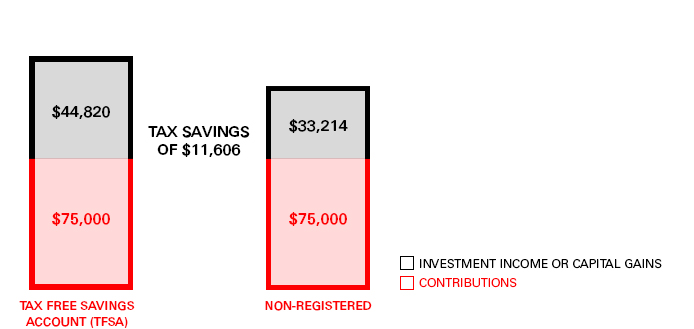

A line of credit to help conquer your goals. Learn more about this low introductory rate. Creditor Insurance. Meet with us Opens a new window in your browser. Teach your kids the value of money and savings. Learn some tips and tools to guide conversations. Learn more about financial education. Find out how much you can save with a TFSA. A tax-free savings account helps you grow your savings because you don’t pay tax on interest or investment income. Step 1 of 4. Where do you live? Step 2 of 4. What’s your annual income?

Comments

Post a Comment