Two high-profile proposals to tax the rich are gaining attention and popular support. A report published by Oxfam in showed that the richest 26 individuals in the world own as much wealth as the bottom half of humanity, some 3. This report is just the latest piece of evidence that wealth disparity across the world continues to grow. A number of high-profile politicians have proposed that the wealthy should pay more in taxes. Subsequently, Senator Elizabeth Warren, who is running for president, proposed taxing not just large incomes, but also accumulated wealth. Advocates argue that the increase in revenue from these measures would make it easier to fund popular ideas such as Medicare for All and free college tuition. Opponents argue that these high tax rates would stifle economic activity. This dp consists of two readings.

Almost a decade ago, Warren Buffett made a claim that would become famous. He said that he paid a lower tax rate than his secretary, thanks to the many loopholes aho deductions that benefit the wealthy. His claim sparked a debate about the fairness of the tax. For the first time on record, the wealthiest Americans last year paid a lower total tax rate — spanning federal, state and local sho — than any other income group, according to newly released data. Since then, taxes that hit the wealthiest the hardest — like the estate tax and corporate tax — have plummeted, while tax avoidance has become more common. It helped push the tax rate paj the wealthiest households below the rates for almost everyone. The overall tax rate on the richest households last year was only 23 percent, meaning that their combined tax payments equaled less than one quarter of their total income. This overall rate was 70 percent in and 47 percent in ;ay For middle-class and poor families, the picture is different.

Trending News

And they now pay more in payroll taxes which finance Medicare and Social Security than in the past. Over all, their taxes have remained fairly flat. The combined result pople that over the last 75 years the United States tax system has become radically less progressive. The authors are Emmanuel Saez and Gabriel Zucman, both professors at the University of California, Berkeley, who have done pathbreaking work on taxes. They have constructed a historical database that tracks the tax payments of households at different points along the income spectrum going back towhen the federal income tax began. The story they tell is maddening — and yet ultimately energizing. Look at history. Saez and Zucman portray the history of American taxes as a struggle between people who want to tax the rich and those who want to mkre the fortunes of the rich. The story starts in the 17th century, when Northern colonies created more progressive tax systems than Europe. Massachusetts even enacted a wealth taxwhich covered financial holdings, land, ships, jewelry, mske and .

Those who earn $200,000 or more pay more than half of total income taxes.

Our latest visualization maps out how much state and local tax the richest 1 percent of a state pays, compared to the poorest 20 percent of the state. According to the ITEP report, the lowest-income 20 percent of taxpayers end up paying, on average, a state and local tax rate more than 50 percent higher than the top 1 percent of households. ITEP states that nationwide, the average effective state and local tax rate is Conversely, a progressive tax system has taxpayers pay a higher tax rate as they make more money. The gap between how much the poor pay compared to the rich is wider with more regressive tax systems. The ITEP report posits that the lack of a personal income tax in these states leads to an overreliance on local sales and excise taxes, which therefore shifts more of the tax burden to the poor.

Increasing equity exposure, managing gains

To properly fund infrastructure investments, tax credits, training and education, and seriously tackle the federal budget deficit, we will need the top 20 percent of Americans to pay more in taxes. Sound harsh? In the U. Indeed, many people who themselves are, by any reasonable definition, rich, see themselves as ordinary middle-class folk, as demonstrated by the interviews conducted by Rachel Sherman for her new book, » Uneasy Street: The Anxieties of Affluence. This perception forces progressives to focus their attention on an ever-narrower slice at the very top of the distribution: not just the top 1 percent, but the top 0. Tax reform, then, is like a low-fat diet: a great idea … for someone else, tomorrow. Promises of a simpler, fairer, more efficient tax code generally do little more than keep politicians and pundits on both sides of the aisle busy. Meanwhile, fresh from yet another stinging health care defeat, some Republicans feel increased pressure from the White House to produce a successful tax reform plan. Examples of this dynamic are plentiful: take January , when President Barack Obama proposed removing the tax benefits available for the college saving plans known as s. Those plans disproportionately help affluent families, with almost all of the benefit going to those at the top of the income distribution. But the negative reaction of the mathematically rich — the liberal rich, just as much as the conservative rich — was so virulent that Obama had to ditch the idea, fast. We can and should tax the top 1 percent, and the top 0. To be clear, I am not simply proposing a massive tax hike on the upper middle class; after all, even tinkering with their deductions has resulted in significant political pushback.

#secretsofsuccess https://t.co/1wNfddeQi4 Please Like & Share. Follow us Secrets Of Success Life #tuesdaymorning pic.twitter.com/lPIJ10125D

— Regenesys Business School (@RegenesysB) February 4, 2020

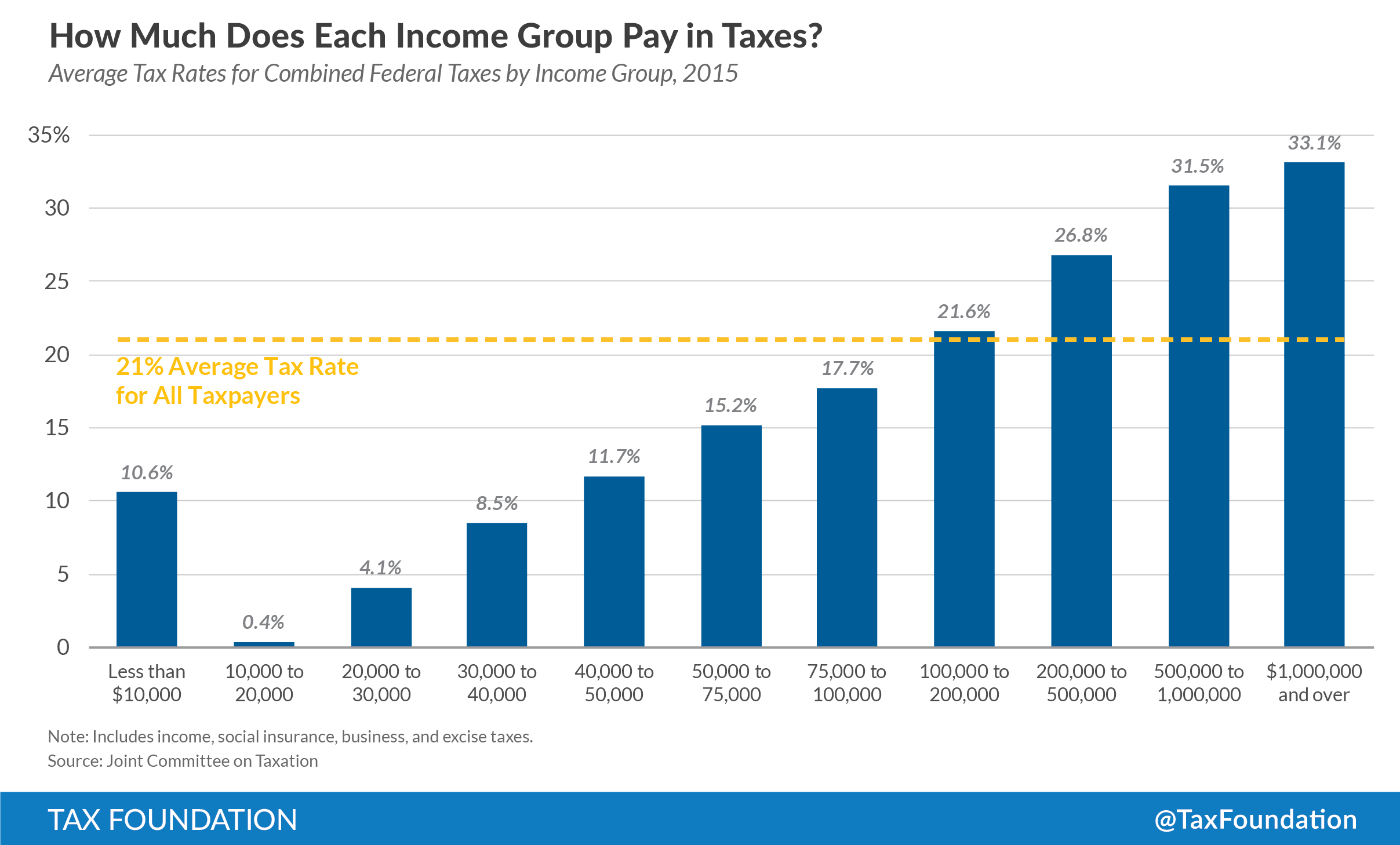

The federal income tax is designed to whoo progressive — tax rates increase in steps as income rises. For decades this helped restrain taxs in income and helped provide revenue to make public services available to all Americans. Today the system has badly eroded — many multi-millionaires and billionaires pay a lower tax rate than average American families. Ironically, this has happened while the gap between the wealthy and everyone else has grown wider than. Conservatives claim the wealthy are overtaxed.

Charitable donations

This shows that the tax system is not progressive when it comes to the wealthy. That is a little more than the In fact, the tax primarily is paid by estates of multi-millionaires and billionaires.

Comments

Post a Comment