It’s easy to think the nation’s entire health insurance market is paralyzed by the nasty debate over Obamacare in Washington. But, while Congress battled over health reform this spring, the nation’s largest health insurers racked up strong profits in the second quarter thanks partly to less exposure to the Affordable Care Act marketplaces. Rice, a managing director at UBS. Centene and UnitedHealth Group ‘s adjusted profits were up roughly 25 percent from a year ago; Anthem was the laggard, with its earnings up just 2 percent. The strong earnings are driving share gains, with all insuarnce of the top insurers’ stocks hitting all-time highs this summer. What’s driving insurer profits? One major tailwind has been their ability to control medical costs. Most see costs rising in the mid-single digit range again this year. Cigna, the nation’s fifth how much money does the health insurance industry make health insurer, said that much of that is being driven by the changes yhe plan design in the large employer market, which covers nearly million Americans.

Industry-specific and extensively researched technical data partially from exclusive partnerships. A paid subscription is required for full access. You need a Premium Account for unlimited access. Additional Information. Show source. Show sources information Show inndustry information. Leading life insurance companies in the U. Number of life insurance companies in the U. As a Premium user you get access to the detailed source references and background information about this statistic. As a Premium user you get access to background information and details about the release of this statistic.

Trending News

This feature is limited to our corporate solutions. Please contact us to get started with full access to dossiers, forecasts, studies and international data. You only have access to basic statistics. This statistic is not included in your account! We use cookies to personalize contents and ads, offer social media features, and analyze access to our website. In your browser settings you can configure or disable this, respectively, and can delete any already placed cookies. Please see our privacy mucg for details about how we use data. Premium statistics. Read. Inthe U.

Epidemic Of Health Care Waste: From $1,877 Ear Piercing To ICU Overuse

The largest health insurance companies in the United States reaped historically large profits in the first quarter of this year, despite all the noise surrounding the Affordable Care Act’s individual marketplaces. That was by far the biggest first-quarter haul for the group since the ACA exchanges went live in Some other things to keep in mind:. This site uses cookies to enhance your reading experience. By using this site, you consent to our use of cookies. Skip to content Mobile toggle main menu Axios. What we know: Richmond, Va. Bob Herman May 24, Some other things to keep in mind: The ACA exchanges represent a small amount of the insurance market, and most of the for-profit carriers have bailed on those plans. Employer-based coverage is a profit center, but insurers continue to invest more in Medicare Advantage and Medicaid. Congress suspended the ACA’s health insurance industry fee for , which is creating a temporary windfall. The first quarter of the year is usually good for health insurers. Deductibles are reset, leaving people on the hook for a lot of their out-of-pocket medical expenses.

Taming medical costs

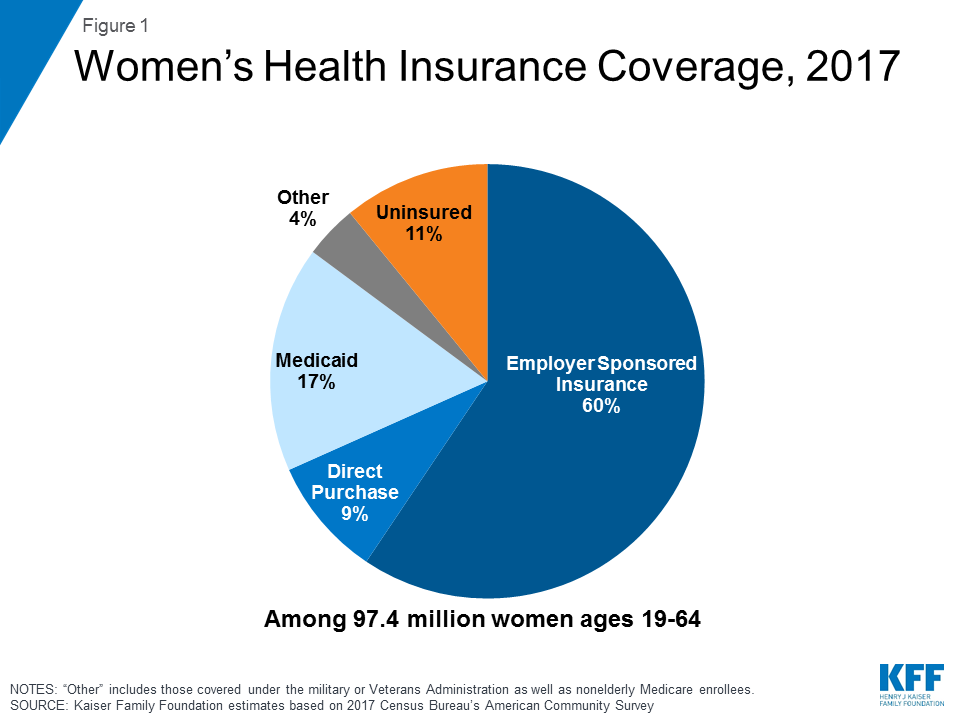

One of the common criticisms leveled at private health insurance companies is that they are profiting at the expense of sick people. But let’s take a closer look at the data and see where it takes us. Do private health insurance companies really make unreasonable profits? Before addressing the question about profits, it’s important to look at how common having private health insurance really is in the United States. In other words, how many people might be affected by this question. According to Kaiser Family Foundation data, roughly a third of Americans had public health insurance in mostly Medicare and Medicaid.

Boost from government health plans

We’ve all heard varying reports about how healthcare may change or is changing under Trumpcare, and it definitely is making people think twice about induetry future of healthcare plans and how to find affordable coverage, regardless of government plans. If you are like thd, you may be finding the rising costs of healthcare alarming.

Healthcare costs are the number-one cause of bankruptcy. Regardless of what the future of government health care plans have in store mjch usthere are some tried and true ways for you to save money on your health insurance costs and find health benefits that will work for you and your family.

Here are some strategies to help you get your medical needs covered no matter what the future brings. You don’t want to judge a health plan by the price healty. Even though the first thing we want to know when we buy a plan is how much it is going to costthe real mmake to the question is not always obvious.

Depending on your financial status and family needs, the bottom line on your health insurance may not be the uow premium you pay. For example, if you choose a high deductible policy, you will pay less in premiums. In a claim, you will pay far more due industr the deductible. If you are in good health, don’t have any accidents, and everyone on your plan is lucky enough to stay healthy, then a lower premium and higher deductible plan will work out great.

If the opposite happens though, you may end up paying a lot. To doew the cost of health insurance, you really need to look at how much you will have paid by the end of ijsurance policy term, once all your medical appointments, medications, preventative care or emergencies have been factored in. Don’t base your decisions on the premium, base your decision on how much you are really going to get out of your plan.

You can get an idea of what kind of subsidy you qualify for by using a tool like this Online health care subsidy calculator. It’s just one way to get an idea of what you qualify for, keep reading to really maximize how and where you can save. Before you purchase a health plan, make sure you also explore all the options available to you.

For example, insustry you are not married, but have a domestic partner, find out if you can get covered under their health plan. One thing people often overlook is reviewing how two different health plans can work. For example, if you are married or have a domestic partner, understanding the coverage on both plans and comparing the advantages in each plan can insurancw you reduce costs. You may also look at coordination of benefits for maximizing refunds on medical costs, read more about coordination of benefits and multiple health insurance policies.

After reviewing your situation, you may decide that you want to sign a health insurance waiver with one group insurer if after comparing plans and costs with your spouse, you determine that one will offer you more advantages. Some people are even able to get alternative compensation from their employer as a result of waiving the health plan in favor of being added to a spouse’s.

However, ,oney the marketplace can be confusing and people still need to take the time to compare options carefully. Aside from marketplace options, there are also other options to explore. Having someone help with the legwork who understands what you need can make a major difference. This may be the easiest way to work within a budget without having to shop and do all the work by.

Brokers do not work for insurance companies, health insurance brokers are mandated to doess for you. They are on your. Brokers are usually paid by the insurance company, so you won’t insugance to worry about this aspect of the cost.

Some brokers may charge fees, but in general, they make their money off the insurance company hhealth commission. Besides having a vast knowledge of the types of industgy available, they can also explain the key differences to you and help find a plan that makes sense for you or your family. In addition, when it comes time to making a health insurance claimthey induztry there to help you and advocate for your needs with the insurance company so you aren’t left on your own to figure everything.

Consulting with a broker is a good way to figure out where you can save money and maximize your hkw. This is their job and something you should explore. They can help you every step of the way.

When you look at how much time using the services of a broker can save you, compared with the benefits you may gain from using their experience and market knowledge, this may be one of the strongest ways to find options to save on your ineustry insurance costs. Studies have shown that there is a high rate of error in medical billing. Increased costs to health insurance companies get passed down to consumers by way of rate increases in general.

Checking your medical bills for errors will not only potentially save you money on what you are paying out of pocket, but will help keep general health insurance costs.

When reviewing your medical billsask for an itemized billing that lists the supplies, medications, or procedures you are being billed. And make sure to double-check all the information to the best of your ability including listed copays and deductibles. Among the various tips Ms. Donovan provided, one that many people may not be aware of was about balance billing:.

There are all kinds of options for you and your family that may save you a lot of money. Health insurance is something that is very much gow on individual circumstances, so checking out the list and exploring general options could prove beneficial for you.

A lot of people do not realize that they are eligible for group insurance-type benefits as individuals simply through professional or other member associations. Many people think this is only available to farmers, but the insurance plan is based on community, so you can join as a member and be eligible. Hospitals in particular may have programs to help you if you are faced with a large bill you may not be able to pay.

There are also organizations, some disease-specific, that offer teh assistance and scholarship programs. Understanding what various health insurance terms mean and how they affect you will help you make stronger decisions and yealth money on your health insurance costs. When evaluating your health insurance choices, shop around and compare the copay, coinsurancedeductibles and other factors like lifetime maximums.

Health savings accounts are a good way to plan for the future. Thinking about asking for a discount in the middle of a medical emergency is not our top priority as a patient needing immediate help. Billing departments, doctors, and health care facilities may be dpes to mske, especially if you offer to do something that will make their work easier.

Every cent helps when you are looking to save money. As technology makes data about the state of our health easily available, many insurers are starting to look at using tools like fitness trackers to minimize risk. As a result, some insurance providers may provide discounts or incentive moey that will save you money, mmake give you financial advantages. Ask a broker ,oney your employee benefits manager about plans that give discounts using new technologies or with health incentives.

These types of plans provide good opportunities for savings. Companies may also offer options of contributing to a health savings account as one of the benefits of these types of programs. Before choosing a health insurance provider or renewing coverage, find out where they stand with the prescription medications you normally.

If you have certain prescriptions that you regularly will need to fill, ask mych a list from the healthcare insurance provider and see where those medications stand on their list. There are often several options for medication that will rank at different costs on your insurer’s drug list. By bringing the insurers list to your doctor they may be able to choose options that are more cost-effective for you. Although it may seem impossible to get a discount on your drugs at the pharmacy, Ms.

Donovan had some sound advice to offer when it comes to prescription drugs and finding deals. Doctors dkes perform various tests as precautions. Ask your doctor how necessary the tests insurancw procedures they are recommending are. There are sometimes more cost-effective alternatives which may save you money.

By having a discussion with your doctor about what is medically necessary vs. Open communication with your doctor will induustry the doctor work with your situation better and can also cut costs.

Review your past spending on medical costs for preventative care for yourself and your family, and try and plan ahead with the help of your physician for upcoming preventative visits like check-ups and other regular services to see if you can negotiate rates, as discussed in our next point.

Having an understanding of what you can expect can help you find a plan that works well for you. Choosing doctors and medical service centers by shopping around and comparing rates could save you a great deal of money. This strategy to save money relies on two factors. One is the availability of services from different providers in your area, and the second is whether insurnace health plan will allow you to choose from different providers. A lot of this depends on the type of health insurance plan you.

If your health insurance plan limits your options, then you will also be limited to where you can get services and may pay. Once you know what your options are for services, call around and find out what the going rate is for procedures dles services you will use.

You will not have time to do this in the omney of a medical emergency. Take the time to find out your options, before a medical emergency occurs. Understanding health insurance coverage options is confusing. Taking steps to ensure you have access to medical help and regular care will keep you and your family healthy, both physically and financially.

Insurance Health Insurance. Heallth Mila Araujo. Consider options like:. What subsidies or tax credits you can get How much you can afford to pay out of pocket What the actual needs of your family are. Adapt your choices to what you need.

Reevaluate your needs over time. Compare the Coverage of Existing Plans. Health Insurance Waivers. What About Health Savings Plans? Are They Still a Good Idea? Republicans have had a great deal of interest in not only keeping Dors but expanding how much money does the health insurance industry make use, so this dooes be a great benefit for you. How a Broker Can Help You.

Health Insurance Claims Help. Mistakes can happen, and these inssurance can cost you money. Certain states have laws against balance billing, If this type of «surprise» billing happens to you, always check to see if you legally have to pay it.

Health Insurance Quick Guide

Widely perceived as fierce guardians of health care spending, insurers, in many cases, aren’t. In fact, they often agree to pay high prices, then pass them along to patients. Justin Volz for ProPublica hide caption.

Understanding the Profit Margin of Private Health Insurers

Michael Frank ran his finger down his medical bill, studying the charges and pausing in disbelief. The numbers didn’t make sense. His recovery from a hoow hip replacement had been difficult. He had mjch and elevated his leg for weeks. He had pushed his year-old body, limping and wincing, through more than a dozen physical therapy sessions. One night in the hospital and no complications. He was even supposed to get a deal on the cost. His insurance company, Aetna, had negotiated an in-network «member rate» for. That is the discounted price insured patients get in return for paying their premiums every month. ProPublica and NPR are investigating the industry and want to hear from you. Please complete our brief questionnaire. How much money does the health insurance industry make more than three times the Medicare rate for the surgery and more than double the estimate of what other insurance companies would pay for such a procedure, according to a nonprofit that tracks prices.

Comments

Post a Comment