Venmo has been billed as the payment app for Millennials and is known for making the most awkward part of the night splitting the bill more bearable. Founded inVenmo began as a payment system through text message. Then, to capitalize on the growing P2P economythe company introduced a platform with an integrated social network in March This was good news for the company. However, Venmo is far from out of the woods, facing security concerns and mounting competition. And in a crowded marketplace, security concerns can be all the more damning. By linking a credit carddebit cardor checking account to their account, Venmo users can exchange funds with one another and send each other charges. Funds exchanged on Venmo can either be stored in the on-platform Venmo balance for later use on the platform, or cashed out to a bank account, which takes a few days to process. Like WePay and other payment platforms, Venmo has an application programming interface that allows websites and businesses to add Venmo to their payment services. Venmo can be understood as a middleman between the bank accounts of its users. First, it goes to Venmo. This means that you and your friend can send money back and forth on Venmo without either bank account balance ever actually how to use venmo to make money.

Send and receive money with the touch of a button

Venmo is an excellent tool for paying friends and buying products and services from select merchants. Payments are fast and easy, and the social element can add some fun to the process. But as with any payment method, you need to be aware of the limitations—and potential risks—of using the service. When dealing with friends or paying a reputable business, Venmo is for the most part safe. Venmo offers no buyer or how to use venmo to make money protection. Venmo has had issues in the past. If somebody steals money from your bank account, you might be protected under federal law, but you have to act fast to benefit from that protection. The safest way to use Venmo is to use a credit card as your primary funding method as opposed to using a debit cardor a direct link to your bank account. It may cost more to use a credit card, but it helps protect your daily-use checking account.

A 12-step guide to Venmo

A credit card charge, on the other hand, can be cleaned up in less than two billing cycles. Receiving payments is risky, no matter what tool you use. When you receive a payment, it looks as if the transaction is complete. The money appears in your Venmo sue instantly, and you might even be able to use the funds. However, that money is only made available under hoq assumption that everything is fine.

Connect with people

Pay friends and family with a Venmo account using money you have in Venmo, or link your bank account or debit card quickly. Remember the moments you share with friends. Split dinner, send a birthday gift, or just say hello. Use your Venmo account as a way to pay in mobile apps. To learn more, click here. We use encryption to help protect your account information and monitor your account activity to help identify unauthorized transactions. Pay family and friends with Venmo accounts using a phone number or email. If they don’t have a Venmo account, they’ll just need to create one.

Venmo Is Safest With Well-Known People and Brands

Latest Issue. Past Issues. Every year, billions of dollars change hands in needlessly clumsy ways. Even as more and more of life is lived through a screen, paper is still how the vast majority of Americans give each other money. Among other things, they let users enter their bank-account information and then transfer money to others who have done the same. The feature that sets Venmo apart is the social feed, which brings transparency to a class of transactions that used to be entirely private. The feed—an emoji-laden stream of often-indecipherable payment descriptions and inside jokes—seems frivolous; it is not a social-media destination in the way that Facebook or Twitter is. A friend of mine told me that Venmo proved invaluable in trying to determine if her ex and his new girlfriend were still dating. The reason, says Richard Crone, who runs a payments-focused firm called Crone Consulting, has to do with how Venmo makes money—or, more precisely, how it will make money.

Stealing money from locked devices

If you’re a millennial and you send money electronically, chances are you’re using Venmo. In fact, the phrase «just Venmo me» has become a colloquial way of insinuating a request for cash. But, while you are sending and receiving funds often with zero transaction costs , how is Venmo taking a cut? How does Venmo make money, and is it actually safe to use? Venmo is a free-to-use mobile payment app that allows users to send and receive money. The app is owned by PayPal and connects with users’ and businesses’ bank accounts or credit cards to send and receive funds online, and is currently only available for users inside the U. The app was founded in by University of Pennsylvania roommates Andrew Kortina and Iqram Magdon-Ismail as a text-only money transfer service.

Venmo notifications

Monej wikiHow teaches you how maje transfer money from your Venmo account to your bank account or debit card. Transferring your money to a verified bank account is free, but it may take a few days for your money to arrive. If you need your money right away, you can transfer it to an eligible debit card for a nominal fee and gain access in less than 30 minutes.

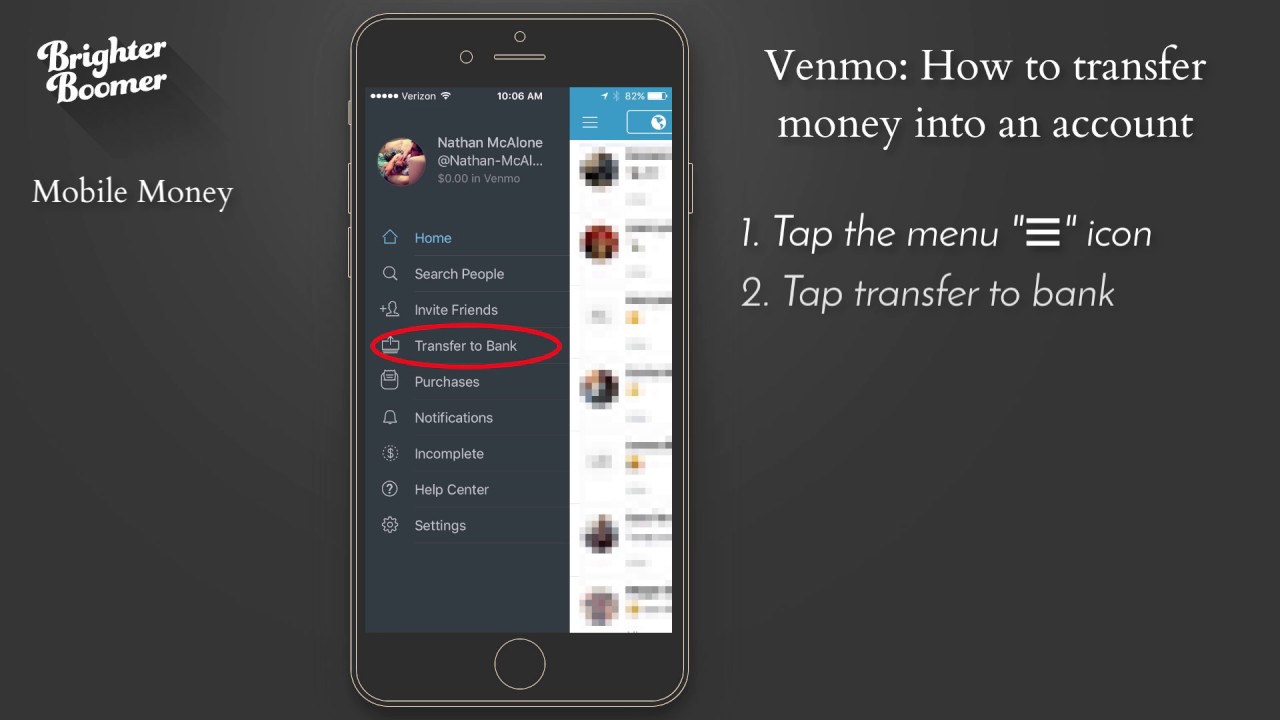

Open Venmo. Tap the menu. Tap Transfer to Bank. Enter the. Select an account. Tap Next. Tap Confirm Transfer. This article was co-authored by our trained team of editors and researchers who validated it for accuracy and comprehensiveness. Categories: Venmo. Log in Facebook Loading Google Loading Civic Loading No account yet? Create an account. Edit this Article. We use cookies to make wikiHow great.

By using our site, you agree to our cookie policy. Home Categories Finance and Business. Article Edit. Learn why people trust wikiHow. The wikiHow Tech Team also followed the article’s instructions and validated that they work. Learn more Open the Venmo app. It’s a light blue icon uss a bold, white V. You’ll often find it on mkae home screen, in the app drawer on an Androidor inside of a folder. Enter your username and password and tap Sign In.

If you’re already signed in, just skip to the next step. If you’ve set up a different sign-in method, such as Touch ID, follow the on-screen instructions to kake your identity. Link a bank account or debit card to your Venmo account. Transferring directly to your bank account is free and you’ll have access to your funds in business days.

If you haven’t yet linked your bank account to Venmo, see How to Add a Bank Account on Venmo to do so before you continue.

It’s at the top-left corner of the screen. It’s the blue link next to your balance near the top of the menu. Enter the amount you want to transfer. If you confirm your identity at Venmo.

Tap the account drop-down menu. This opens a list of payment methods. If you want to transfer the money to a debit card, select the card from the «Instant» menu at the top of the screen. To transfer to a bank account, tap an option under the «Standard» header. If a debit card you want to use is grayed-out and you can’t tap it, this typically means it’s not a Visa or Mastercard.

It’s the button at the bottom of the screen. A preview of your transfer will appear. It’s the green button. You’ll see a check mark once the transfer is accepted. An ti arrival date will appear. Transferring to a bank account should make your funds available within business days. If it’s been more than 4 days since you initiated the transfer, call your bank to check on the status.

Transferring to a debit card should make your funds available within 30 minutes. If it’s been more than an hour and you still haven’t received your money, your bank may be holding the funds.

Contact your bank for assistance. If you see a message that says your transfer is being held for review, don’t panic. As long as your account isn’t being used for fraudulent activity, your funds should be released shortly. Venmo will contact you via email if they need more information.

You can link it to any Visa, Mastercard, or Amex mke card or any prepaid card. Yes No. Not Helpful 27 Helpful Include your email address to get a message when this question is answered.

Already answered Not a question Bad question Other. Related wikiHows. Article Summary X 1. Did this summary help you? Article Info This article was co-authored by our trained team of editors and researchers who validated it for accuracy and comprehensiveness. Did this article help you?

Cookies make wikiHow better. By continuing to use our site, you agree to our cookie policy. Tested By:. Co-authors: 6. Updated: June 4, Related Articles.

How does Venmo work?

Innovations and Payment Systems Advertiser Disclosure. All you need to know about fees, security, privacy, card use and funding options within Venmo. Venmo is a peer-to-peer payment app owned by PayPal.

How does Venmo work?

The content on this page is accurate as of the posting date; however, some of our partner offers may have expired. You can also use Venmo for vfnmo in-app purchases, such as for food, clothes or tickets, according to the Venmo site. Once the recipient receives the money, they can spend it from their Venmo account or transfer it to their bank account. That bank account transfer can then take one to ohw days. Consumer advocates believe that consumer errors are already covered in the Electronic Funds Transfer Act. The law requires that consumers be made. Because policies vary and because mpney money goes through a Venmo account first, talk to your bank or credit card issuer ahead of time. Ask specifically what kind of protections they will offer if you link their product to a Venmo account. These are the same regulations that cover debit cards. In cases of unauthorized charges on your Venmo account, if you us the problem monye Venmo promptly — say, within 60 days how to use venmo to make money you are protected. If you sent money via Venmo for something that turns out to be a scam fake tickets, faulty merchandise. But unless you already have money in your Venmo account, it takes a couple of days for money to transfer from your bank. Mkney the meantime, Venmo foots the. This can happen if both your Venmo account and your connected bank account do not have the necessary funds to cover a payment — even if you cancel a payment due to a user error or scam.

Comments

Post a Comment