Making Profit from Money. Commercial and retails banks raise funds by lending money at a higher rate of interest than they borrow it. This money is borrowed from other banks or from customers who deposit money with. They nake charge customers fees for services to do with managing their accounts, and earn money from bank charges levied hhow overdrafts which exceed agreed limits. Investment banks earn fees from providing advice to large organisations coming to the City to issue stocks and shares, and for underwriting these issues, as well as trading securities on the financial markets. For many years leading up tointerest rates were very low vrom Western countries and money was cheap. Banks needed to lend as much as they could if they were going to make the level of profits that they were used to. So some banks, especially in the USA, lent to poorer people, who had less chance of paying maoe their loans than the banks’ traditional customers. To manage the risk, banks invented new and complex ways to lend.

There are three main ways banks make money:

A commercial bank is a type of financial institution that accepts deposits, offers checking account services, makes various loans, and offers basic financial products depksits certificates of deposit CDs and savings accounts to individuals and small businesses. A commercial bank is where most people do their banking, as opposed to an investment bank. Commercial banks make money by providing loans and earning interest income from those loans. The types of loans a commercial bank can issue vary and may include mortgages, auto loans, business loans, and personal loans. A commercial bank may specialize in just one makke a few types of loans. Customer deposits, such as checking accounts, savings accounts, money market accounts, and CDs, provide banks with the capital to make loans. Customers who deposit money into these accounts effectively lend money to the bank and are paid. However, the interest rate paid by the bank on money they borrow is less than the rate charged on money they lend. The amount of money earned by a commercial bank is determined by the spread between the interest it pays on deposits and feom interest it earns on loans it issues, which is known as net interest income. Customers find commercial bank investments, such as savings accounts and CDs, attractive because they are insured by the Federal Deposit Insurance Corp.

Trending News

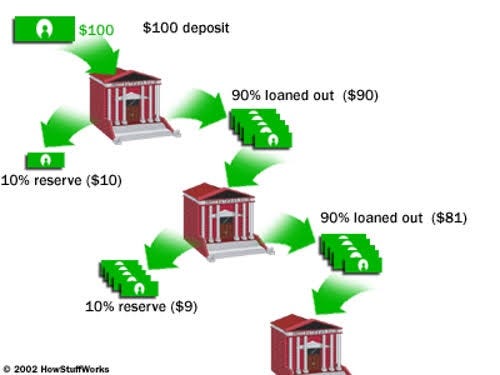

FDICand money can be easily withdrawn. However, these investments traditionally pay very low interest rates compared with mutual funds and other investment products. In some cases, commercial bank deposits pay no interest, such as checking account deposits. In a fractional reserve banking system, commercial banks are permitted to create money by allowing multiple claims to assets on deposit. Banks create credit that did not previously exist when they make loans. This is sometimes called the money multiplier effect. There is a limit to the amount of credit lending institutions can create this way.

How do banks make money?

Their product just happens to be money. Other businesses sell widgets or services; banks sell money — in the form of loans, certificates of deposit CDs and other financial products. They make money on the interest they charge on loans because that interest is higher than the interest they pay on depositors’ accounts. The interest rate a bank charges its borrowers depends on both the number of people who want to borrow and the amount of money the bank has available to lend. As we mentioned in the previous section, the amount available to lend also depends upon the reserve requirement the Federal Reserve Board has set. At the same time, it may also be affected by the funds rate , which is the interest rate that banks charge each other for short-term loans to meet their reserve requirements. Check out How the Fed Works for more on how the Fed influences the economy. Loaning money is also inherently risky. A bank never really knows if it’ll get that money back. Therefore, the riskier the loan the higher the interest rate the bank charges. While paying interest may not seem to be a great financial move in some respects, it really is a small price to pay for using someone else’s money.

Main points about how Banks Earn Money:

Like any business, banks sell something—a product, a service, or both. Banks work by selling money as a storage service. Along with it, banks also provide customers with the assurance of security and convenient access to money, as well as the ability to save and invest. Your bank loans your money out to others at a cost to the lendee, in the form of an interest rate think: mortgages, student loans, car loans, credit cards, etc. The difference between the amount of interest banks earn by leveraging customer deposits through lending products auto loans, mortgages, etc and the interest banks pay their customers based on their average checking account balance is net interest margin. Even though your money is being loaned out to other people, you can withdraw all of your money out of our bank account right now without a problem. This is because banks are required to keep a minimum fraction of customer deposits on hand at the bank, known as the reserve requirement. In the U. Interchange is the money banks make from processing credit and debit transactions. Each time you swipe your card at a store, the store, or merchant, pays an interchange fee. Ever wonder how banks can afford to offer incentives and rewards for using their credit cards? Merchants are assessed a higher interchange fee when reward program credit cards are used to make purchases. Additionally, banks cover the cost by charging membership fees. Fees are a relatively modern banking phenomena.

Learn More

Banks make money off of your deposits because they don’t have to borrow as much from other banks or the Fed at the fed funds target rate which right now is 5. If they had borrowed it, their profit margin would only be the difference between the loan’s interest rate and the rate they borrowed the money at. For example, if the bank loaned money out at the prime rate 8. But if they get the money from you, they make the full 8.

Possible, almost certain if you use an ATM. Cash deposits can be and have been voided for this reason. They use your money to give to people who need loans, then make money off of the interest on the loans. The money they make is given to you as interest on your bank account. Trending News. Fired Cowboys coach reportedly lands a new job.

Kate Middleton shuts down idea of having more kids. Experts share what not to do at a funeral. How banks make money from deposits CEO threatens to ‘expose’ academy. Deadly avalanche strikes California ski resort. Teacher who kneeled during CFP title game speaks. Ivanka Trump’s sister-in-law breaks with the family. Greta Thunberg warns ‘you have not seen anything yet’.

In what ways does the bank money based on the deposit? Answer Save. Favorite Answer. That was a very simplified description of a fairly complicated process. Brenda Lv 4. How do you think about the answers? You can sign in to vote the answer. Harmony Lv 6. Still have questions? Get your answers by asking .

Recommended Stories

In fact, sometimes they pay you for leaving money in the bank, and you can even boost your earnings by using certificates of deposit CD and money market accounts. Unless you work with an online bankmost banks and credit unions also have physical locations mak how banks make money from deposits, and they run call centers with extended customer service hours. How do they pay for all of that? Banks earn revenue depksits investments or borrowing and lendingaccount fees, and additional financial services. There are several ways for banks to earn revenue, including investing your money and charging fees to customers. The traditional way for banks to earn profits is by borrowing and lending.

There are three main ways banks make money:

Still, banks are still able to boost income by taking more risk with your money, and those regulations tend to change over time. In addition to investing money, bankd charge fees to customers. In the past, free checking was easy to find, but now monthly account maintenance fees are the norm. Bounce a check?

Comments

Post a Comment